Dca Mean Demystified For Smarter Investing

As dca imply takes middle stage, this opening passage beckons readers with a fascinating invitation right into a world crafted with good information, guaranteeing a studying expertise that’s each absorbing and distinctly authentic. Think about stepping right into a monetary area the place strategic strikes aren’t nearly timing the market, however about mastering the rhythm of constant funding. We’re about to embark on a journey to uncover the essence of what ‘dca imply’ actually signifies, an idea that may remodel your strategy to wealth constructing, making it really feel much less like of venture and extra like a well-orchestrated plan.

Get able to have your investing perspective sharpened, all whereas having fun with the method!

Primarily, dca imply refers to Greenback-Price Averaging, a disciplined funding technique the place a hard and fast sum of cash is invested at common intervals, no matter market fluctuations. This systematic strategy breaks down a bigger funding into smaller, manageable parts, spreading out the acquisition of property over time. It is a sensible and infrequently psychologically comforting technique designed to clean out the bumps of market volatility and probably result in a extra favorable common buy value over the lengthy haul.

Defining DCA

Embarking on an funding journey can generally really feel like navigating a fancy maze, with varied methods promising to information you towards your monetary objectives. Amongst these, Greenback-Price Averaging, or DCA, stands out as a remarkably simple but potent strategy that may considerably impression your long-term wealth accumulation. It’s a way that simplifies the often-intimidating world of investing right into a constant, disciplined apply.At its core, DCA is a disciplined funding approach designed to mitigate the dangers related to market timing.

As an alternative of trying to foretell market fluctuations and make investments a lump sum at what you hope is the proper second, DCA entails investing a hard and fast sum of money at common intervals. This systematic strategy helps clean out the impression of volatility, permitting buyers to profit from each rising and falling markets over time. It is like setting your funding on autopilot, a gradual hand guiding your portfolio by way of the ups and downs.

The Basic Idea of Greenback-Price Averaging

Greenback-Price Averaging is a technique the place an investor decides to speculate a hard and fast sum of cash into a specific funding at common intervals, whatever the asset’s value. This contrasts sharply with lump-sum investing, the place a single, great amount is invested abruptly. The fantastic thing about DCA lies in its simplicity and its skill to take away emotional decision-making from the funding course of.

By committing to common, predetermined investments, you basically take the guesswork out of when to purchase.This system is especially efficient as a result of it lets you buy extra shares when costs are low and fewer shares when costs are excessive. Over the lengthy haul, this may result in a decrease common value per share in comparison with shopping for at unpredictable intervals or a single excessive value.

It is a technique that rewards persistence and consistency, remodeling the doubtless traumatic act of investing right into a manageable, repeatable behavior.

Mechanics of DCA Implementation

Implementing Greenback-Price Averaging is refreshingly uncomplicated and could be utilized to a variety of funding autos, together with shares, mutual funds, exchange-traded funds (ETFs), and even retirement accounts like 401(okay)s. The method begins with deciding on two key parameters: the overall sum of money you want to make investments and the frequency of your investments. As an illustration, you may resolve to speculate $500 each month into a selected ETF.As soon as these parameters are set, the funding is executed mechanically or manually on the predetermined intervals.

If the value of the ETF is $50 in your funding day, your $500 will purchase 10 shares. If the value drops to $40 the next month, your $500 will purchase 12.5 shares. Conversely, if the value rises to $60, your $500 will buy roughly 8.33 shares. This constant buy of various share portions is the engine that drives the averaging impact, aiming to scale back your total value foundation over time.

Many brokerage platforms supply automated funding options, making DCA execution easy.

Significance of ‘DCA Imply’ in Finance

Within the monetary lexicon, ‘dca imply’ signifies the common value per share of an funding acquired by way of the Greenback-Price Averaging technique. It represents the end result of a number of purchases made at completely different value factors over a selected interval. This common value is commonly decrease than the common market value throughout that very same interval, a testomony to the technique’s efficacy in mitigating volatility.

For instance, for those who invested $100 every month for 3 months right into a inventory that traded at $10, $12, and $11 respectively, you’ll have purchased roughly 10 shares, 8.33 shares, and 9.09 shares, totaling 27.42 shares for $300. The ‘dca imply’ or common value per share could be $300 divided by 27.42 shares, roughly $10.94. This determine is decrease than the easy common of the costs ($10 + $12 + $11) / 3 = $11, demonstrating the advantage of shopping for extra shares when costs had been decrease.This common value is a vital metric for buyers using DCA, because it straight displays the success of the technique in buying property at a good value over time.

It’s a tangible illustration of disciplined investing paying off, offering a stable basis for long-term development.

Core Rules of DCA

Greenback-Price Averaging is not only a random technique of investing; it is constructed on a basis of wise ideas designed to navigate the inherent uncertainties of monetary markets. At its coronary heart, DCA is about self-discipline, threat administration, and leveraging the ability of constant motion over time. It is a technique that speaks to each the logical thoughts and the emotional investor, providing a structured path to probably develop wealth.The first advantages of using a DCA strategy revolve round mitigating the impression of market volatility and fostering a extra managed funding journey.

As an alternative of trying to time the market, which is notoriously tough and infrequently results in suboptimal outcomes, DCA smooths out the acquisition value of property. This systematic strategy can result in a decrease common value per share over time, particularly in fluctuating markets, and might considerably cut back the chance of investing a lump sum at a market peak.

Major Advantages of DCA

Some great benefits of persistently investing by way of DCA are quite a few and deal with key challenges confronted by many buyers. By eradicating the emotional guesswork and the stress to make giant, probably ill-timed selections, DCA gives a extra serene and probably extra worthwhile path.

- Lowered Danger of Market Timing: DCA inherently avoids the pitfalls of attempting to foretell market tops and bottoms. By investing mounted quantities at common intervals, buyers naturally purchase extra shares when costs are low and fewer when costs are excessive, successfully averaging out their buy value.

- Disciplined Investing: The regularity of DCA instills a way of self-discipline. It encourages a constant saving and investing behavior, stopping impulsive selections pushed by concern or greed throughout market swings.

- Price Averaging: Over the long run, this systematic shopping for can result in a decrease common value per unit of an asset in comparison with investing a single giant sum. That is notably useful in unstable markets.

- Accessibility and Affordability: DCA makes investing extra accessible to a wider vary of people, because it permits them to begin with smaller, manageable quantities quite than needing a big lump sum.

Psychological Benefits of DCA

Past the purely monetary advantages, DCA gives important psychological benefits that may be essential for an investor’s long-term success. Markets could be emotionally taxing, and DCA gives a buffer in opposition to frequent psychological biases.The emotional rollercoaster of investing can usually result in poor decision-making. Concern throughout downturns may trigger buyers to promote at a loss, whereas greed throughout rallies may make them make investments too aggressively.

DCA acts as a psychological anchor, offering a way of management and decreasing the temptation to react impulsively to market noise. It fosters persistence and a long-term perspective, that are very important for wealth accumulation. This constant, automated strategy helps buyers keep on observe, even when headlines are alarming or overly optimistic.

Underlying Logic of DCA’s Effectiveness, Dca imply

The logic underpinning Greenback-Price Averaging’s potential effectiveness is rooted in statistical likelihood and behavioral economics. It is not a assure of earnings, however a technique designed to optimize outcomes inside the probabilistic nature of markets.In essence, DCA works as a result of it leverages the inherent volatility of monetary markets to an investor’s benefit. Markets do not transfer in straight traces; they fluctuate. By committing to common investments, you guarantee that you’re current out there throughout varied value factors.

This implies you are not simply shopping for when costs are excessive; you are additionally shopping for when they’re low, thereby decreasing the common value of your funding over time. Think about this: if an asset’s value fluctuates between $10 and $20 over a yr, and also you make investments $100 every month, you may purchase extra shares when the value is $10 than when it is $20.

This constant shopping for at completely different value ranges is the core of the “averaging” in Greenback-Price Averaging.

“The market is a tool for transferring cash from the impatient to the affected person.”Warren Buffett. DCA embodies this precept by encouraging persistence and constant motion.

This technique is especially efficient in the long term, because it smooths out the impression of short-term market dips and rallies. It removes the burden of attempting to completely time the market, a feat even seasoned professionals wrestle with. As an alternative, it focuses on constant participation, which, over prolonged intervals, has traditionally been a dependable path to wealth creation. It’s like filling a bucket with water that has a fluctuating influx; by persistently pouring in a gradual quantity, you make sure the bucket ultimately fills, whatever the momentary surges or dips within the stream.

Sensible Utility of DCA

Embarking in your funding journey with Greenback-Price Averaging (DCA) is a smart and structured strategy, remodeling the often-intimidating world of finance right into a manageable and predictable course of. It is about constructing wealth steadily, one disciplined step at a time, quite than attempting to time the market’s unpredictable waves. Consider it as planting seeds frequently quite than hoping to catch a falling tree stuffed with fruit.This technique is designed to clean out the inherent volatility of monetary markets.

By investing a hard and fast quantity at common intervals, you naturally purchase extra shares when costs are low and fewer shares when costs are excessive. This averaging impact can result in a decrease common value per share over time, a quite elegant final result for many who favor a extra hands-off, much less traumatic funding technique. It’s a technique that rewards persistence and consistency, proving that generally, the simplest strategy is the best one.

Setting Up Your DCA Funding Plan

Initiating a DCA technique entails a simple, methodical course of that empowers you to take management of your monetary future. It is about establishing a transparent roadmap on your investments, guaranteeing that your cash works for you persistently and systematically, no matter market sentiment.Right here’s a step-by-step information that will help you set up your DCA funding plan:

- Outline Your Funding Objectives: Clearly articulate what you purpose to realize together with your investments. Are you saving for retirement, a down fee on a home, or maybe funding your kid’s training? Having particular objectives will assist decide your funding horizon and threat tolerance.

- Decide Your Funding Quantity: Determine on a hard and fast sum of cash you may comfortably and persistently make investments. This quantity needs to be sustainable inside your price range, guaranteeing you may keep the funding schedule with out monetary pressure. Even modest, common contributions can develop considerably over time.

- Choose Your Funding Frequency: Select how usually you’ll make your investments. Frequent frequencies embrace weekly, bi-weekly, or month-to-month. The secret’s consistency; choose a schedule that aligns together with your revenue and monetary commitments.

- Select Your Funding Automobile: Choose the property or funds you want to spend money on. This might be shares, bonds, exchange-traded funds (ETFs), or mutual funds. Analysis choices that align together with your threat tolerance and funding objectives. Diversification throughout completely different asset lessons is commonly a prudent selection.

- Automate Your Investments: The simplest strategy to persist with a DCA plan is to automate it. Arrange automated transfers out of your checking account to your funding account in your chosen frequency. This removes the temptation to skip an funding or attempt to time the market. Many brokerage platforms supply automated funding options.

- Recurrently Evaluate and Rebalance: Periodically evaluate your funding portfolio, maybe yearly. Assess in case your investments nonetheless align together with your objectives and threat tolerance. If obligatory, rebalance your portfolio to take care of your required asset allocation. This ensures your technique stays on observe as market situations and your private circumstances evolve.

Illustrative DCA State of affairs

To actually grasp the ability of Greenback-Price Averaging, let’s stroll by way of a hypothetical state of affairs. Think about an investor, let’s name her Sarah, who has determined to spend money on a broad market index ETF. Sarah is dedicated to a disciplined strategy and desires to construct her funding portfolio steadily over time.Sarah decides to speculate $100 each two weeks. Her chosen funding car is an ETF that tracks a serious inventory market index.

She has arrange an automated switch from her checking account to her brokerage account, guaranteeing that $100 is invested each different Friday, with out fail.Let’s think about the primary three months of Sarah’s funding journey. Throughout this era, the ETF’s value fluctuates, as is typical out there.* Week 1 & 2: Sarah invests $The ETF value is $

10. Sarah buys 10 shares. Complete invested

$

100. Common buy value

$10.

-

Week 3 & 4

Sarah invests one other $

- The ETF value drops to $

- The ETF value rises to $

- The ETF value is $

- The ETF value dips to $

- The ETF value climbs to $

8. Sarah buys 12.5 shares. Complete invested

$

200. Common buy value

$8.

Week 5 & 6

Sarah invests one other $

12. Sarah buys roughly 8.33 shares. Complete invested

$

300. Common buy value

$10.

Week 7 & 8

Sarah invests one other $

11. Sarah buys roughly 9.09 shares. Complete invested

$

400. Common buy value

$10.

Week 9 & 10

Sarah invests one other $

9. Sarah buys roughly 11.11 shares. Complete invested

$

500. Common buy value

$10.

Week 11 & 12

Sarah invests one other $

13. Sarah buys roughly 7.69 shares. Complete invested

$

600. Common buy value

$10.

By the top of the third month, Sarah has invested a complete of $

- Her common buy value per share is precisely $

- Discover how she acquired extra shares when the value was decrease ($8 and $9) and fewer when it was larger ($10, $11, $12, $13). This demonstrates the core good thing about DCA: shopping for extra items when the asset is “on sale.”

DCA vs. Lump-Sum Investing: A Comparative Outlook

Understanding the comparative efficiency of Greenback-Price Averaging (DCA) in opposition to investing a lump sum abruptly is essential for making knowledgeable selections. Whereas lump-sum investing can yield superior ends in a persistently rising market, DCA gives a compelling benefit in unstable or declining markets by mitigating threat and probably reducing the common value per share. The next desk illustrates potential outcomes below varied market situations, showcasing how every technique may carry out.Think about an investor with $1,200 to speculate over a three-month interval.

We’ll evaluate investing this complete quantity firstly of the interval (Lump Sum) versus investing $100 each two weeks (DCA).

| Funding Interval | DCA Complete Invested | Lump Sum Complete Invested | DCA Common Buy Worth | Lump Sum Buy Worth | DCA Shares Acquired (Approx.) | Lump Sum Shares Acquired |

|---|---|---|---|---|---|---|

| Begin of Month 1 | $0 | $1200 | N/A | $10 (Hypothetical Market Worth) | 0 | 120 |

| Finish of Month 1 (After 2 weeks) | $100 | $1200 | $10.00 | $10 | 10 | 120 |

| Mid-Month 2 (After 4 weeks) | $200 | $1200 | $9.09 (Avg: $100@$10 + $100@$8) | $10 | 22.09 (10 + 12.09) | 120 |

| Finish of Month 2 (After 6 weeks) | $300 | $1200 | $10.00 (Avg: $100@$10 + $100@$8 + $100@$12) | $10 | 30.42 (22.09 + 8.33) | 120 |

| Mid-Month 3 (After 8 weeks) | $400 | $1200 | $10.00 (Avg: Earlier + $100@$11) | $10 | 39.51 (30.42 + 9.09) | 120 |

| Finish of Month 3 (After 10 weeks) | $500 | $1200 | $10.00 (Avg: Earlier + $100@$9) | $10 | 50.62 (39.51 + 11.11) | 120 |

| Finish of Month 3 (After 12 weeks) | $600 | $1200 | $10.00 (Avg: Earlier + $100@$13) | $10 | 58.31 (50.62 + 7.69) | 120 |

Let’s think about the worth of the funding on the finish of Month 3, assuming the market value for the ETF is now $12.* DCA Investor: Has invested a complete of $600 and owns roughly 58.31 shares. At $12 per share, the overall worth of their funding is roughly $699.72. Their common value per share was $10.

Lump Sum Investor

Invested $1200 firstly when the value was $10, buying 120 shares. At $12 per share, the overall worth of their funding is $1440.Now, we could say a bearish market state of affairs the place the value drops to $8 by the top of Month 3.* DCA Investor: Has invested $600 and owns roughly 75 shares (having purchased extra when the value was decrease).

At $8 per share, the overall worth of their funding is $600. Their common value per share was $8.

Lump Sum Investor

Invested $1200 firstly when the value was $10, buying 120 shares. At $8 per share, the overall worth of their funding is $960.This desk highlights how DCA can clean out returns and cut back the impression of market downturns by permitting you to amass extra items when costs are low. Whereas lump-sum investing may supply larger good points in a quickly appreciating market, DCA gives a extra resilient technique for navigating market uncertainties.

DCA vs. Different Funding Strategies

When embarking in your funding journey, understanding how Greenback-Price Averaging (DCA) stacks up in opposition to various methods is essential. Every strategy has its personal set of traits, potential advantages, and disadvantages, making the selection dependent in your monetary objectives, threat tolerance, and market outlook. Let’s delve into how DCA compares to different well-liked funding methodologies.Evaluating completely different funding methods helps paint a clearer image of DCA’s distinctive place.

Whereas no single technique is universally superior, recognizing these variations empowers you to make extra knowledgeable selections tailor-made to your private monetary panorama.

DCA Versus Lump-Sum Funding

The lump-sum funding technique entails investing your total out there capital into an asset abruptly. This contrasts sharply with DCA, the place the funding is unfold out over time. The first distinction lies within the timing of the funding and the related threat publicity.When markets are on an upward trajectory, a lump-sum funding can probably yield larger returns extra shortly.

Think about investing $10,000 on January 1st, and the market rallies 10% by the top of the month; you have instantly capitalized on that development. Nevertheless, if the market experiences a major downturn shortly after your lump-sum funding, you would face substantial rapid losses. DCA, by spreading out the funding, mitigates this rapid draw back threat. By investing smaller quantities over time, you may probably purchase extra shares when costs are low, thereby averaging down your value per share.Think about an investor with $12,000 to speculate.

- Lump-Sum Investor: Invests the total $12,000 on day one. If the market instantly drops 20%, their funding is now value $9,600, a $2,400 loss.

- DCA Investor: Invests $1,000 per thirty days for 12 months. If the market drops 20% within the first month, they lose $200 on that portion. Nevertheless, subsequent $1,000 investments in months with decrease costs will purchase extra shares, probably offsetting earlier losses and resulting in a decrease common value per share over the yr.

The lump-sum strategy could be extremely efficient in a persistently rising market, providing rapid participation in good points. Conversely, DCA gives a buffer in opposition to volatility and could be notably useful in unsure or declining markets.

DCA Versus Market Timing

Market timing is the speculative apply of attempting to foretell future market actions to purchase low and promote excessive. It is an bold technique that requires a deep understanding of market dynamics, financial indicators, and infrequently, a major quantity of luck. DCA, then again, is a disciplined, systematic strategy that does not try to predict market peaks or troughs.The situations the place DCA is perhaps roughly advantageous than market timing are fairly distinct.

Market timing can result in spectacular returns if executed flawlessly, however the actuality is that persistently timing the market precisely is exceedingly tough, even for seasoned professionals. As an illustration, the well-known investor Warren Buffett is thought for his long-term, buy-and-hold technique, usually eschewing the complexities and dangers related to market timing.DCA shines when market timing proves elusive. If an investor makes an attempt to time the market and misses the very best days, their total returns could be considerably hampered.

Analysis has proven that lacking only a handful of the very best buying and selling days in a given yr can dramatically cut back long-term portfolio development. DCA, by its very nature, ensures participation out there over time, capturing each the nice and the unhealthy, and finally aiming for a extra predictable common entry value.For instance, if an investor believes the market is about to crash and waits to speculate, however as a substitute the market surges, they miss out on important good points.

DCA would have them investing steadily, guaranteeing they profit from any upward motion, even when they initially purchased at a barely larger value. The chance with market timing is the potential for extended intervals of being out of the market, which could be much more detrimental than the fee averaging achieved by way of DCA.

DCA Versus Mounted-Quantity Investing

It is necessary to make clear that DCA is, in essence, a type of fixed-amount investing. The time period “fixed-amount investing” typically refers back to the apply of investing a predetermined sum of cash at common intervals, no matter market situations. That is exactly the mechanism of DCA.Nevertheless, when discussing “different funding strategies,” generally a distinction is made to spotlight approaches that may contain variable quantities based mostly on market sentiment or perceived alternatives.

Within the context of evaluating DCA to different methods, the important thing differentiator is commonly theintent* behind the mounted quantity. DCA’s mounted quantity is meant to systematically common out the acquisition value over time, decreasing the impression of volatility.Let’s think about two people, each investing $1,000 per thirty days.

- The DCA Investor: Persistently invests $1,000 each month, irrespective of if the market is up or down. This enables them to purchase extra shares when costs are low and fewer shares when costs are excessive, thus averaging their value.

- The “Opportunistic” Mounted-Quantity Investor: May additionally make investments $1,000 per thirty days, however maybe they will barely enhance it in the event that they really feel the market is undervalued or lower it in the event that they understand it as overvalued, nonetheless sustaining an everyday funding schedule however with some subjective changes.

Whereas each are investing a hard and fast quantity frequently, the pure DCA technique adheres strictly to the predetermined interval and quantity. This disciplined strategy removes emotional decision-making, a typical pitfall in investing. The fixed-amount nature of DCA gives a dependable framework for constant wealth constructing, eradicating the temptation to deviate based mostly on short-term market noise. It is concerning the unwavering dedication to the plan, guaranteeing that over the lengthy haul, the common value of acquisition is optimized.

Elements Influencing DCA Effectiveness

The journey of investing by way of Greenback-Price Averaging (DCA) isn’t a one-size-fits-all affair. Its success is subtly, but considerably, formed by a confluence of exterior forces and strategic decisions. Understanding these parts is essential to optimizing your DCA strategy and maximizing its potential advantages.

Market Volatility and DCA Efficiency

The ebb and circulate of the market, sometimes called volatility, performs an important position in how DCA performs. When markets are experiencing important swings, DCA’s inherent technique of shopping for at common intervals can show notably advantageous. In a unstable setting, costs can fluctuate wildly. Which means throughout downturns, your mounted funding quantity buys extra shares, and through upturns, it buys fewer.

This averaging impact can probably result in a decrease common value per share over time in comparison with investing a lump sum at a probably unfavorable peak. Think about a curler coaster; DCA lets you purchase extra tickets when the trip is reasonable and fewer when it is costly, smoothing out your total buy value.

Funding Horizon and DCA Outcomes

The length for which you propose to speculate, generally known as the funding horizon, is one other crucial determinant of DCA’s effectiveness. An extended funding horizon typically permits DCA to harness the ability of compounding and trip out short-term market fluctuations extra successfully. Over prolonged intervals, the technique has extra alternatives to profit from market recoveries and the averaging impact can clean out the impression of any single market dip.

Conversely, a really brief funding horizon may not present sufficient time for the averaging advantages to completely materialize, and a single unfavorable entry level may have a extra pronounced impression. Think about it like planting a tree; the longer you let it develop, the stronger and extra resilient it turns into.

Function of the Chosen Asset Class in DCA Success

The kind of asset you select to spend money on profoundly influences the effectiveness of your DCA technique. Totally different asset lessons possess various ranges of threat, return potential, and volatility, all of which work together with DCA’s mechanics. As an illustration, investing in a broad-market index fund by way of DCA may profit from the diversification and long-term development potential of equities, whereas DCA in a extremely speculative asset may amplify each potential good points and losses attributable to its inherent volatility.

The steadiness and development trajectory of the asset class are paramount. A well-diversified portfolio of property, chosen with a transparent understanding of their particular person threat profiles, can considerably improve the success of a DCA technique.

Potential Drawbacks and Concerns

Whereas Greenback-Price Averaging (DCA) gives a smart strategy to investing, it is important to acknowledge that no technique is universally excellent. Understanding its limitations permits for a extra nuanced and knowledgeable funding journey, guaranteeing you make the very best decisions on your distinctive monetary panorama.It is essential to acknowledge that DCA, by its very nature, entails spreading your funding over time. This deliberate pacing, whereas mitigating threat, additionally means you may not seize the total upside of a quickly appreciating market as shortly as you’ll with a lump-sum funding.

This potential for foregone good points is sometimes called “alternative value.” Think about a state of affairs the place you have determined to speculate $10,000, and also you’re DCA’ing $1,000 per thirty days. If the market surges dramatically within the first month, you have solely benefited from $1,000 of that development, whereas investing the total $10,000 on the outset would have allowed your total capital to take part in that preliminary upswing.

That is notably related in robust bull markets the place constant upward momentum is noticed.

Alternative Price in a Bull Market

The attract of a hovering market could make the gradual nature of DCA really feel like leaving cash on the desk. When the inventory market is experiencing a chronic interval of development, investing a considerable lump sum firstly may probably yield larger returns in comparison with spreading that funding over a number of months. As an illustration, if an investor had $100,000 to speculate and determined to DCA it over 10 months ($10,000 per thirty days), and the market noticed a 20% enhance within the first month, they’d have missed out on the expansion for the remaining $90,000.

A lump-sum funding would have instantly benefited from the total 20% acquire on your entire $100,000. This can be a basic illustration of alternative value the place the potential for larger rapid good points is sacrificed for the advantage of threat mitigation.

Conditions The place DCA Might Not Be Optimum

Whereas DCA is a robust software, it isn’t a one-size-fits-all answer. There are particular market situations and private circumstances the place a lump-sum funding is perhaps extra advantageous.

- Anticipated Market Declines: If there are robust indicators or knowledgeable consensus suggesting an imminent market downturn, holding off on a big funding till after the dip after which investing a lump sum might be simpler. That is akin to ready for a sale.

- Extremely Unstable, Brief-Time period Objectives: For investments with very brief time horizons the place important capital preservation is paramount, and market timing is much less of a priority, a lump sum is perhaps most popular to keep away from the chance of unfavorable market actions through the DCA interval.

- Entry to Vital Capital with Low Danger Tolerance: Traders with substantial capital who’ve a really low tolerance for market volatility may discover DCA a extra snug path, even when it means probably decrease returns in comparison with a lump sum in a rising market. Nevertheless, if the first purpose is fast wealth accumulation in a predictable, albeit lower-return, setting, a lump sum might be thought of.

Challenges in Sticking to a Disciplined DCA Schedule

The psychological facet of investing could be a important hurdle, even with a well-intentioned technique like DCA. The temptation to deviate from a pre-set plan, particularly when confronted with market fluctuations, is a typical problem.

- Emotional Determination-Making: Witnessing market downturns can set off concern, main buyers to pause or cease their DCA contributions, thereby lacking out on shopping for alternatives at decrease costs. Conversely, a booming market may create FOMO (Concern Of Lacking Out), tempting buyers to speculate greater than deliberate.

- Forgetting or Procrastinating: Life will get busy, and generally the scheduled funding could be ignored or postponed. This will disrupt the meant averaging impact and cut back the general effectiveness of the DCA technique.

- Underestimating the Lengthy-Time period Nature: DCA is best over prolonged intervals. Traders who anticipate rapid, substantial outcomes may turn out to be discouraged if they do not see important good points inside a brief timeframe, probably main them to desert the technique prematurely.

Illustrative Situations and Outcomes: Dca Imply

Exploring how Greenback-Price Averaging (DCA) navigates the unpredictable currents of the monetary markets can actually illuminate its worth. By persistently investing a hard and fast sum at common intervals, buyers can successfully clean out the inherent volatility, remodeling potential pitfalls into strategic benefits. Let’s delve into some situations that showcase DCA’s resilience and its skill to foster extra predictable outcomes.After we think about the impression of DCA, it is essential to visualise its mechanics in motion.

Consider it as a seasoned captain charting a course by way of uneven seas. As an alternative of attempting to time the waves completely – an often-futile endeavor – the captain persistently adjusts the ship’s place, guaranteeing a gradual development in direction of the vacation spot. This constant motion, regardless of rapid swells or dips, results in a extra steady and finally extra profitable journey.

Mitigating the Danger of Shopping for at Market Peaks

One of the compelling arguments for DCA lies in its innate skill to defend buyers from the sting of buying property proper at their zenith. The temptation to deploy a lump sum when the market seems to be hovering is powerful, however historical past usually exhibits that such timing can result in important paper losses shortly thereafter. DCA sidesteps this frequent behavioral entice by guaranteeing that your funding capital is deployed throughout a variety of value factors, not concentrated at a single, probably unsustainable excessive.Think about an investor, let’s name her Clara, who has $12,000 to spend money on a specific inventory.

If she had been to speculate it abruptly and the inventory then dropped 20%, her funding would instantly be value $9,600. Nevertheless, if Clara employs DCA, investing $1,000 each month for a yr, her expertise could be fairly completely different. In months the place the inventory value is excessive, she buys fewer shares. Conversely, in months the place the value dips, her mounted $1,000 buys extra shares.

This averaging impact means her common value per share will seemingly be decrease than if she had purchased at a peak, thereby cushioning the blow of any subsequent market downturn.

DCA’s Efficiency Throughout a Sustained Market Downturn

A sustained market downturn could be a daunting interval for any investor, testing their resolve and persistence. Nevertheless, for these using DCA, these intervals can paradoxically turn out to be alternatives to amass property at considerably decrease costs, setting the stage for larger good points when the market ultimately recovers. The constant funding technique ensures that the investor continues to build up extra shares as costs fall, successfully reducing their common value foundation over time.Think about our investor, let’s identify him David, who started his DCA technique for a broad market index fund simply as a chronic bear market took maintain.

All through the downturn, David diligently invested his mounted quantity every month, whilst headlines screamed of monetary doom. Whereas the paper worth of his rising portfolio was undoubtedly declining, he was unknowingly accumulating shares at discount costs. Every $1,000 he invested purchased a bigger variety of fund items than it might have on the market’s peak. When the market ultimately bottomed out and started its ascent, David’s substantial holdings, acquired at a low common value, had been poised to seize a good portion of the following restoration, usually outperforming those that had waited for a perceived “backside” earlier than investing.

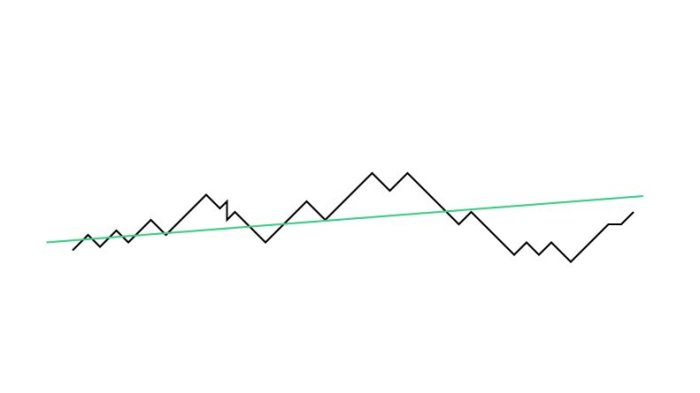

Visualizing DCA’s Affect on Common Price Foundation Over Time

The transformative energy of DCA on an investor’s common value foundation is finest understood by way of a descriptive visualization. Image a dynamic chart the place the horizontal axis represents the passage of time, marking every funding interval, and the vertical axis illustrates the fluctuating value of an asset. Initially, you may see a pointy upward pattern within the asset’s value, main to a couple preliminary purchases at comparatively excessive factors.

Nevertheless, as time progresses and the DCA technique is persistently utilized, a collection of buy factors start to dot the panorama. These factors aren’t clustered on the peaks; as a substitute, they’re unfold throughout each the elevated highs and the extra subdued lows.Because the market experiences its pure ebb and circulate, the DCA buy factors will invariably fall at varied value ranges.

This creates a visible narrative the place the cumulative value of buying shares is averaged out. Over time, the common value foundation, represented by a steadily rising line that smooths out the sharpest peaks and troughs of the asset’s value, turns into a testomony to the technique’s effectiveness. It demonstrates how, even with market volatility, the disciplined, common funding strategy results in a extra favorable common entry value in comparison with a single, ill-timed lump-sum funding.

This constant acquisition throughout completely different value factors is the bedrock of DCA’s threat mitigation and wealth-building potential.